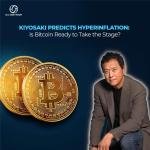

If you’ve been watching Ethereum lately, you might have noticed something exciting brewing — and yes, BlackRock is right in the middle of it. Over just two days, April 24 and 25, BlackRock’s iShares Ethereum Trust (ETHA) pulled in a whopping $94 million in net inflows, according to data from Sosovalue. That’s $40 million on the first day and another $54.45 million the next.

Image Source: SoSoValue

So, what does this mean? Well, when big money pours into ETHA, BlackRock has to go out and buy real Ethereum to back those new shares. And that’s exactly what they did. Right now, BlackRock holds around 1.145 million ETH, valued at an impressive $2.07 billion with Ethereum trading around $1,808.

This kind of aggressive buying isn’t just about bigger numbers on a spreadsheet. It's adding serious momentum to the market. Ethereum has been flirting with critical support levels, but thanks to institutional demand like this, it’s stabilized nicely above the $1,800 mark — a key psychological level that bulls desperately wanted to hold.

But here’s where it gets even more interesting…

Ethereum Breaks Out: Could a 20% Rally Be Next?

Since mid-December, ETH had been stuck in a frustrating descending regression channel — think of it like a long, slow, downward-sloping prison. Every bounce? Lower. Every dip? Just another heartache for traders.

Image Source: TradingView

But not anymore. On the daily chart, Ethereum finally broke out of that channel, and that’s a pretty big deal. Right now, ETH is facing its next battle at the 50-day Exponential Moving Average (EMA) sitting around $1,869.

Why does this matter? Because technical traders — the ones who swear by their moving averages — see a close above the 50 EMA as a green light. Pair that with a strengthening MACD histogram, and you've got a recipe for some serious bullish momentum.

If Ethereum can crack that resistance and close convincingly above it, the next major target isn’t small potatoes — it’s up at $2,164, right around the 200-day EMA. That’s about a 20% upside from where we are now.

Of course, there’s always a “but”...

If the 50 EMA proves too tough to beat and ETH gets rejected, the first support to watch is around $1,746 — the old upper boundary of the descending channel. A drop below that, and things could start looking dicey again.

Final Thoughts

BlackRock throwing nearly $100 million into Ethereum exposure over just 48 hours isn’t something to ignore. It signals that institutional appetite for ETH is alive and well, especially as spot products like ETHA make it easier for big players to get involved.

Combine that with a fresh technical breakout and growing bullish signals, and we might just be seeing the early stages of a much larger move.

If ETH can keep this momentum going and break above that key $1,869 mark, don’t be surprised if the rally everyone’s been waiting for finally kicks off.

Strap in — Ethereum's next chapter could be just getting started.