Bitcoin is having a tough time holding its ground. It’s down 1.24% in the past 24 hours, now trading at $83,015—but could a deeper drop be on the horizon? Let’s break down what’s happening in the market and how does it impact the BTC’s next move.

Table of contents [Show]

- Weak BTC Support Below $80K: A Crash Waiting to Happen?

- Bank of Korea Rejects Bitcoin—Does It Matter?

- Saylor Says Bitcoin is a National Security Asset—Can It Save BTC?

- MicroStrategy Buys More BTC—Will It Stop the Bleeding?

- The Monday Curse Is Broken—Is This a Turning Point?

- So, Where Does Bitcoin Go From Here?

Weak BTC Support Below $80K: A Crash Waiting to Happen?

Bitcoin’s recent struggles highlight a major risk—what happens when BTC rises too fast there’s no solid ground under it? According to Glassnode, the price range between $70K and $80K barely saw any trading activity. Therefore, this creates a “supply gap”, meaning there aren't enough buyers at these levels to provide support. If BTC falls below $80K, there’s not much stopping it from sliding further.

Image source: Glassnode

And here’s another problem—20% of Bitcoin’s total supply is currently at a loss. Short-term holders have already dumped 100,000 BTC, adding to the selling pressure. If the downward momentum continues, $73K—the March 2024 all-time high—could be the next key level to watch. Will buyers take charge before that happens?

Bank of Korea Rejects Bitcoin—Does It Matter?

Just as Bitcoin struggles with support levels, institutional interest isn’t looking great either. While the U.S. is debating a Strategic Bitcoin Reserve, South Korea’s Bank of Korea (BOK) has slammed the door on BTC, refusing to add it to its foreign exchange reserves. Why? They cite high volatility, conversion costs, and non-compliance with IMF rules.

This decision by South Korean Central Bank might seem like a small deal, but it adds to Bitcoin’s struggles. Central banks increasing their BTC holdings would have been a massive confidence boost, but with BOK stepping away, it weakens the investment case. Could other institutions follow this trend?

https://x.com/BitcoinMagazine/status/1901555609427738800

Saylor Says Bitcoin is a National Security Asset—Can It Save BTC?

Amid all the uncertainty, Bitcoin still has some powerful advocates. Michael Saylor is doubling down on Bitcoin’s importance—not just as an investment, but as a national security asset. At a Bitcoin Policy Institute event, he pushed Major Jason Lowery’s ‘SoftWar’ thesis, arguing that Bitcoin’s 800 exahashes of encryption power make it a serious defense against AI-driven cyber threats.

https://x.com/btcpolicyorg/status/1900200862326161787

Saylor’s message? Countries need to stockpile BTC, not just individuals. His strong support to BTC has provided some market confidence today. But is it enough to reverse Bitcoin’s recent slide?

MicroStrategy Buys More BTC—Will It Stop the Bleeding?

If Bitcoin is struggling, MicroStrategy isn’t showing any fear. The company just grabbed 130 BTC worth $10.7 million, bringing its total holdings to 499,226 BTC (that’s 2.4% of Bitcoin’s total supply!). This latest buy, funded through a new ATM offering, shows their long-term belief in Bitcoin.

https://x.com/Cointelegraph/status/1901605860658299037

But did it help the market? Not really. BTC initially rose on the news but then dipped 0.3%. Still, MicroStrategy’s relentless buying reassures investors that Bitcoin remains a strategic asset. Will other institutions follow their lead?

The Monday Curse Is Broken—Is This a Turning Point?

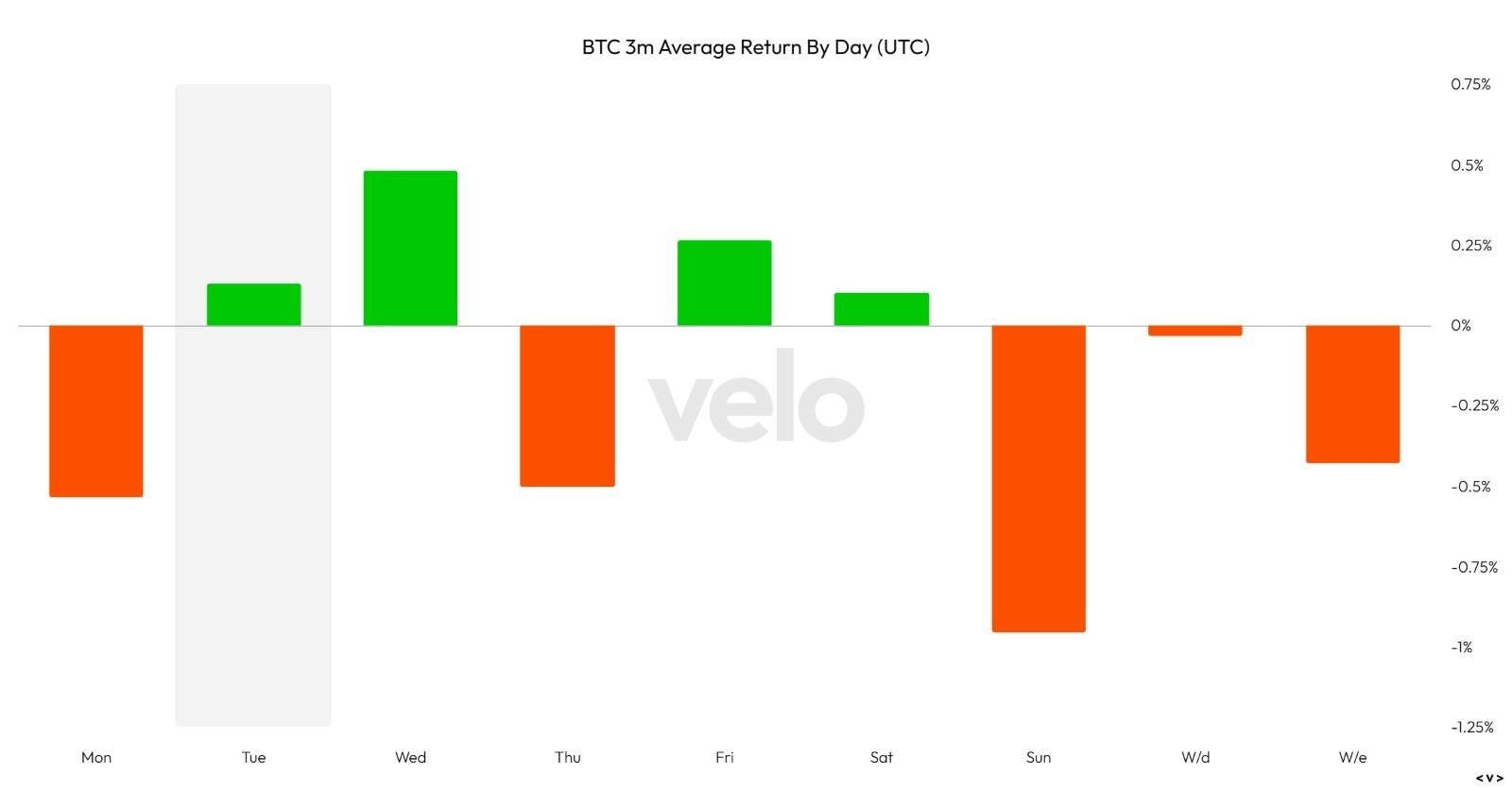

All of these factors add up to a troubling trend—Bitcoin just can’t catch a break on Mondays. Over the past four Mondays, BTC has taken a beating:

Feb. 17: -0.31%

Feb. 24: -4.6%

March 3: -8.5%

March 10: -2.6%

Image Source: Velo

That’s part of a 30% drop from Bitcoin’s all-time high in January. The pattern isn’t random—data from Velo and Coinglass shows that Sundays and Mondays are the worst-performing days for BTC, with Sundays averaging a 1% decline. What’s causing this? Geopolitical tensions, tariffs, and rising bond yields are fuelling weekend volatility, and it’s spilling into Mondays.

Image Source: Velo

However, on yesterday, after four straight weeks of Monday losses, Bitcoin finally bucked the trend. BTC closed Monday up by 1.82% which clearly suggests a potential shift in momentum. This break in the pattern could mean that selling pressure may be easing, and Bitcoin might be gearing up for a recovery.

So, Where Does Bitcoin Go From Here?

Bitcoin finally broke its Monday curse with a 1.82% gain—could this be the start of a comeback? After weeks of downward pressure, this shift hints that sellers might be losing control. But is one green Monday enough to turn things around?

With weak support below $80K and institutions still hesitant, BTC isn’t out of the pressure just yet. Still, big players like MicroStrategy aren’t backing down, and Michael Saylor keeps calling it a must-have asset.

So, what happens next? Will Bitcoin ride this momentum higher, or is this just a temporary break before another dip?