To begin, let’s start with a question:

Why are companies putting Bitcoin on their balance sheets?

Because it’s no longer just about dollars and cents, rather, it is about being smart with idle cash. And the reason is to hedge against inflation and to stay ahead of the financial curve. The Solution: the Bitcoin treasury strategy.

Table of contents [Show]

- So, What’s a Bitcoin Treasury Strategy Anyway?

- Who Are These Bitcoin Treasury Companies?

- Why Would a Company Hold Bitcoin?

- The Bitcoin Treasury Boom: Just How Big Is It?

- How Do Companies Build a Bitcoin Treasury?

- Who Are the Top Bitcoin Treasury Players?

- But Wait—Is There a Risk of Bitcoin Investments?

- So, What’s the Future of Bitcoin Treasuries?

So, What’s a Bitcoin Treasury Strategy Anyway?

In simple terms, it’s when companies take part of their spare cash, the funds just sitting there, and convert it into Bitcoin. Instead of letting that money lose value over time, they’re using Bitcoin as a long-term reserve. Think of it as corporate savings… just in digital gold.

Big names like Strategy, formerly known as MicroStrategy, Tesla, and even GameStop are doing this. MicroStrategy bitcoin holdings alone stand at over 592,100 BTC, which is worth more than $62 billion as of June 2025.

Who Are These Bitcoin Treasury Companies?

“Bitcoin treasury companies” are firms, either public or private, that officially hold Bitcoin as part of their corporate reserves. In simple terms, they have put a chunk of their business funds into BTC. Why? Let’s break it down.

Why Would a Company Hold Bitcoin?

There are a few solid reasons for adopting Bitcoin treasury strategies:

1. Liquidity and Flexibility

Bitcoin trades 24/7. No market hours, no borders. Companies that work globally can use BTC for international transactions with fewer hassle.

2. Inflation Hedge

Currencies lose value over time. Bitcoin, with its fixed supply, is often seen as protection against inflation just like a digital vault.

3. Portfolio Diversification

Why stick to boring, low-yield bonds when Bitcoin offers potential for high returns? It’s risky, yes, but that is where the reward might be.

4. Attracting Investors

Public companies investing in bitcoin can appeal to crypto-hungry investors. They can even offer crypto-tied products like convertible debt or BTC-backed stock. That’s a gateway for institutional investors who can’t buy crypto directly.

The Bitcoin Treasury Boom: Just How Big Is It?

If you still think that it is only about just a few tech weirdos stacking BTC to follow the Bitcoin market trends. Then, you are wrong and need to think again. Because:

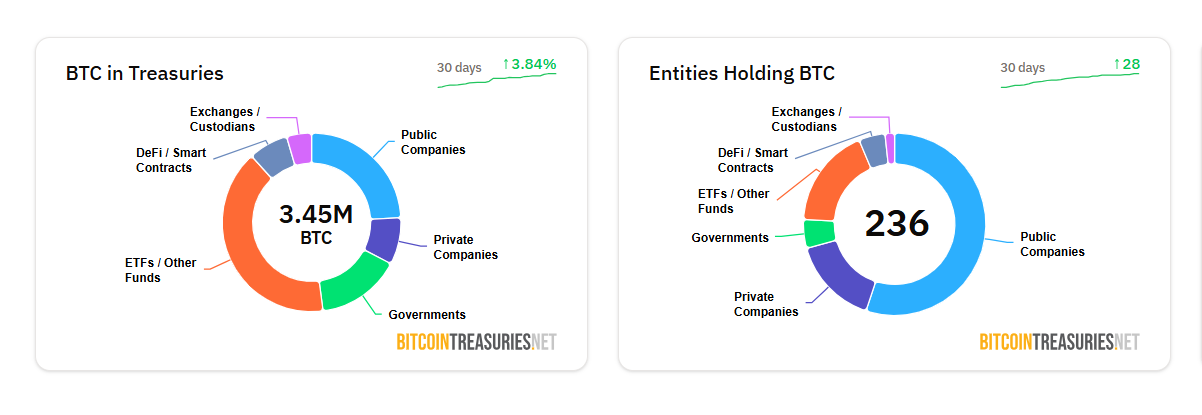

There are about 131 public companies holding bitcoin with a combined 832,162 BTC worth over $85 billion.

Private companies hold another 292,364 BTC. It means, over 5% of all Bitcoin in existence are sitting in corporate vaults.

And yes, it is still growing. To give an idea of cryptocurrency buying spree, there has been nearly a 4% rise in BTC holdings just in the past month.

How Do Companies Build a Bitcoin Treasury?

There’s no one-size-fits-all method for crypto treasury strategies. Here are some common approaches:

Some firms go all in with big, one-time purchases (like Strategy did in 2020). Others take it slow with Dollar-Cost Averaging (DCA)—buying small amounts regularly to reduce risk. A few even take out BTC-backed loans to buy more Bitcoin without touching their cash reserves.

2. Safe Storage

Holding BTC isn’t like keeping cash in a bank. Companies use regulated custodians like Coinbase Custody or BitGo to keep their assets safe. Security is non-negotiable.

3. Funding the Purchase

Where does the money come from for this BTC strategy? A few options:

Convertible notes (borrow now, convert to equity later).

ATM offerings (sell small batches of stock gradually).

Preferred stock (raise money without giving up control).

Or just plain old cash reserves, if they’ve got it.

Who Are the Top Bitcoin Treasury Players?

Let’s meet the biggest names in the corporate bitcoin investments:

Strategy (MSTR)

Holds: 592,100 BTC of worth approx. $62B

Known as the OG Bitcoin treasury company.

Uses equity sales, ATM offerings, and convertible notes to fund BTC purchases.

Marathon Digital (MARA)

Holds: 49,543 BTC of worth approx. $5.1B

A U.S. Bitcoin mining powerhouse that’s stacking coins long-term.

Twenty One Capital (XXI)

Holds: 37,230 BTC of worth approx. $3.87B

Prepping to go public via a $3.6B SPAC deal. Big moves ahead.

Riot Platforms (RIOT)

Holds: 19,225 BTC of worth approx. $2B

Runs one of the most advanced mining operations in North America.

Galaxy Digital (GLXY)

Holds: 12,830 BTC of worth approx. $1.34B

Founded by Mike Novogratz, offers crypto investment services and asset management.

But Wait—Is There a Risk of Bitcoin Investments?

Of course. Bitcoin isn’t a sure bet.

If prices drop sharply, companies could be forced to liquidate, causing a chain reaction of sell-offs. This means, the famous bitcoin volatility is a huge risk to the entire crypto market.

Also, many of these companies trade at market caps higher than the value of the BTC they hold. Why? Because in some regions, investors can’t directly buy Bitcoin or ETFs—so they go through these companies instead. But once ETFs become widely accessible, demand for this “proxy exposure” may vanish. When that happens, valuations could take a hit—especially for companies with weak core businesses.

So, What’s the Future of Bitcoin Treasuries?

Here’s what’s likely:

More companies will adopt BTC as a hedging tool.

Those with smart treasury strategies will have an easier time raising capital.

As the industry matures, expect better scalability and less volatility.

And don’t forget the governments—they’re starting to join in too.

The U.S. has even discussed creating a Strategic Bitcoin Reserve while Ukraine has already introduced a law for it, and countries like Germany are debating whether to treat seized BTC as a long-term asset rather than dumping it on the market. Even Trump Media Company has also filed for its own Bitcoin and Ethereum ETF.

With Bitcoin ETFs now live in the U.S., traditional investors have more access than ever—meaning the line between Wall Street and crypto is getting blurrier by the day.

Final Thoughts

Bitcoin isn’t just a bet anymore—it’s becoming part of corporate strategy. Whether it’s to fight inflation, attract investors, or shake up old finance models, companies are finding ways to make BTC work for them.

Is this a passing trend? Or the start of something bigger?

If corporate giants are jumping on the Bitcoin bandwagon… maybe it’s worth asking why.